Demand for air cargo resumes

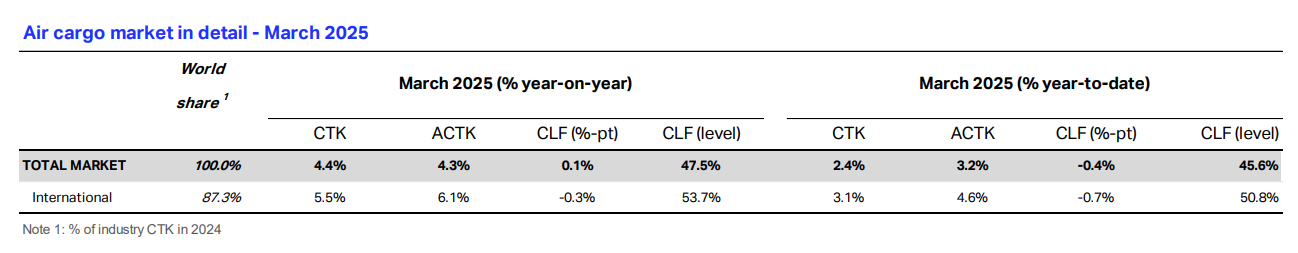

• The industry’s air cargo demand, measured in Cargo-Tonne-Kilometers (CTK), climbed 4.4% YoY in March, returning from February’s brief, mild decline. Seasonally adjusted, CTK rose by 3.3% from February 2025, also reversing February’s soft fall.

• International CTK saw a rise of 5.5% YoY, with most regions and routes posting single-digit gains. Asia Pacific airlines led with 9.6% YoY growth. The Europe-North America trade lanes recorded an 8.5% increase, while the Africa-Asia route sank for a fourth consecutive month, down 40.2% YoY.

• Global available cargo space, Available Cargo Tonne-Kilometers (ACTK), expanded by 4.3% from last March, while capacity utilization, Cargo Load Factor (CLF), ended up by 0.1 points to 47.5% from March 2024.

• Jet fuel costs dropped by 17.3% YoY, marking nine straight months of yearly decline, while cargo revenue rates climbed by 3.8% yearly and 6.6% from February.

Global air cargo demand moderately rebounds Global air freight volumes reached a historic March peak, showing 4.4% YoY growth in CTK. This increase follows a slight decline in February (Chart 1). Typically, March volumes rise after a lull in February, driven by the easing of holiday demand. This year’s modest single-digit increase aligns with trends observed in years not influenced by postCOVID recovery factors, where such gradual gains were common. Moreover, a frontloading effect could be implemented to mitigate the tariff impacts in April.

Air shipments increased by 3.2% month-on-month (MoM) from February to March, after seasonal adjustments. This jump matches past trends, but current events may have contributed to the boost. The sharp rise in U.S. tariffs may have prompted companies and buyers to make purchases in advance to avoid significant import fees. Air cargo demand grew across most regions in March. Asia Pacific led the growth with a 9.3% increase, followed by Latin America and the Caribbean at 5.6%. North American carriers rebounded from a decline (- 1.3%) in February to achieve a growth rate of 3.7%. European airlines experienced a 4.4% increase. However, carriers in the Middle East and Africa faced ongoing challenges for the third consecutive month. The Middle East recorded its smallest decline so far at 3.3%, while Africa saw its sharpest drop at 13.4%. Both regions are experiencing the effect of a strong 2024, which suggests that 2025 will be a challenging year. International trade lane North America bounces back Global freight edged up in March, with cross-border shipments leading. International cargo jumped 4.1% from February with seasonal factors removed and 5.5% YoY without adjustment—marking a sharp recovery from February's stagnant performance (Chart 2).